Published work

Productivity Slowdown and Tax Havens: where is measured value creation ?, Journal of International Economics, vol. 143, July 2023.

with Margarita Lopez-Forero and Jean-Charles Bricongne

SciencesPo Discussion Paper # 2022-07 (older version available as Banque de France working paper #835)

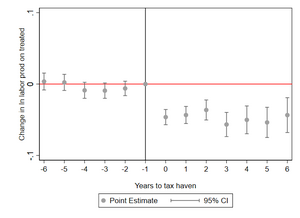

Abstract: Based on French firm-level data over 15 years we evaluate the contribution of the microlevel profit-shifting –through tax haven foreign direct investments– to the aggregate productivity slowdown measured in France. We show that firm measured productivity in France declines over the immediate years following the establishment in a tax haven, with an average estimated drop by 3.5% in labor apparent productivity. Our results moreover suggest that this bias is bigger when firms rely more intensively on intangible capital. Finally, given these firms’ weight in the economy, our results imply an annual loss of 9.7% in terms of the aggregate annual labor productivity growth.

Summary available on VoxEU and in French as an OFCE blog post

Trade Imbalances, Fiscal Imbalances and the Rise of Protectionism, IMF Economic Review, May 2024

with Philippe Martin and Etienne Fize

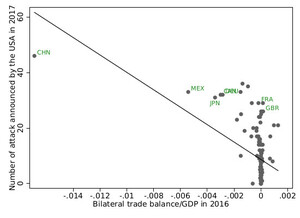

CEPR DP #15742Abstract: We investigate the role of trade imbalances and fiscal policies in the rise of protectionism on the period 2009-2019. Bilateral as well as multilateral trade imbalances are robust (with various sets of fixed effects) predictors of protectionist attacks. The role of trade imbalances in the rise of protectionism is confirmed when we instrument trade imbalances by the cyclically adjusted budget balances. Countries with more expansionary fiscal policies react to the ensuing trade imbalance by a more protectionist trade policy. The role of trade imbalances and fiscal policies in the rise of protectionism is quantitatively important: in the G20, a one standard deviation increase in the bilateral and multilateral trade deficits of a country leads respectively to a 9% and 24% rise of protectionist attacks by this country. A one standard deviation deterioration of the budget balance of a country is associated with a 10% rise in protectionist measures.

Summary available on VoxEU

Working Papers

with Francesco Turino

Abstract: In 2019, 34 billions euros (1.4% of GDP) were spent in France on advertisement and promotional marketing. In order to assess the aggregate implications of commercial communication, we build a DGSE model in which heterogeneous households feature endogenous preferences over differentiated goods and firms strategically advertise and promote their products. The results of the Bayesian estimation provide evidence in favor of a market-size effect of commercial communication in France, with marketing activities by firms that exert a quantitatively important stimulus for the economic activity both in the short- and in the long-run. These effects are driven by a work and spend mechanism, according to which exposure to brand marketing makes individuals willing to work more in order to consume more. Counterfactual scenarios show that taxes on commercial communication can be welfare improving as it alleviates this consumerist gear.

with Felix Hugger and Ana-Cinta González Cabral and Pierce O'Reilly

Abstract: This paper examines real responses of large multinational enterprises to tax by studying the global allocation of their business functions such as manufacturing and sales or financial and holding functions. Drawing on a novel dataset , the study explores the relationship between the location of such business functions and effective corporate taxation. The findings indicate that higher average effective tax rates are associated with a lower prevalence of functions related to holding or the provision of internal group finance. In contrast, more routine functions, such as sales or manufacturing appear less sensitive to average effective tax rates. Finally, business functions also respond to a variety of other features of CIT systems, such as tax incentives, loss carryover provisions, or anti-avoidance rules. The results offer valuable insights into the structure of MNEs global value chains, as well as the real economic impacts of corporate taxation.

Work in Progress

Abstract: The annual number of lawsuits between multinational firms and States through Investor-State Dispute (ISDS) panels is steadily increasing. In the context of a growing need for international regulatory cooperation, these disputes are controversial because of the chilling effect they may have on policy adoption and diffusion. This paper first investigates theoretically whether these concerns are well grounded, and then, under which conditions investors can strategically challenge a regulation in one country in order to hinder its diffusion in other jurisdictions where they have a presence. Multinational firms might have incentives to do so when their legal bases are close from one country to another, and when States' expected litigation costs are sufficiently high. These predictions are tested empirically using the landmark case of the tobacco industry, a highly globalized sector where many regulatory disputes between multinational firms and States have arisen. The results suggest that litigation does hinder policy diffusion.

Abstract: The spread of Investors-State Dispute Settlement (ISDS) provisions in international agreements provides foreign investors with increased ways to curb adverse regulatory changes in the countries in which they invested. This paper asks to which extent the international arbitration represents a threat from the policy makers' perspective and thus a lever for firms to get more favorable conditions. To do so, firm-level data on the power sector are matched with country-level information on investment treaties networks as well as tax-related ISDS cases to identify their role in determining MNEs' effective taxation. While the mere legal possibility of a firm to resort to ISDS courts is not associated with lower effective tax rates, actual tax- related disputes appear to be more salient signals: when a firm challenges a tax change using ISDS, the effective tax rates faced by other MNEs operating in the same jurisdiction decrease suggesting that ISDS cases have effects beyond the expected firm-level compensation.

Awarded Accessit Best Paper at IOEA conference